The Cryptocurrency Gamble: Trump’s High-Stakes Con with Public Funds

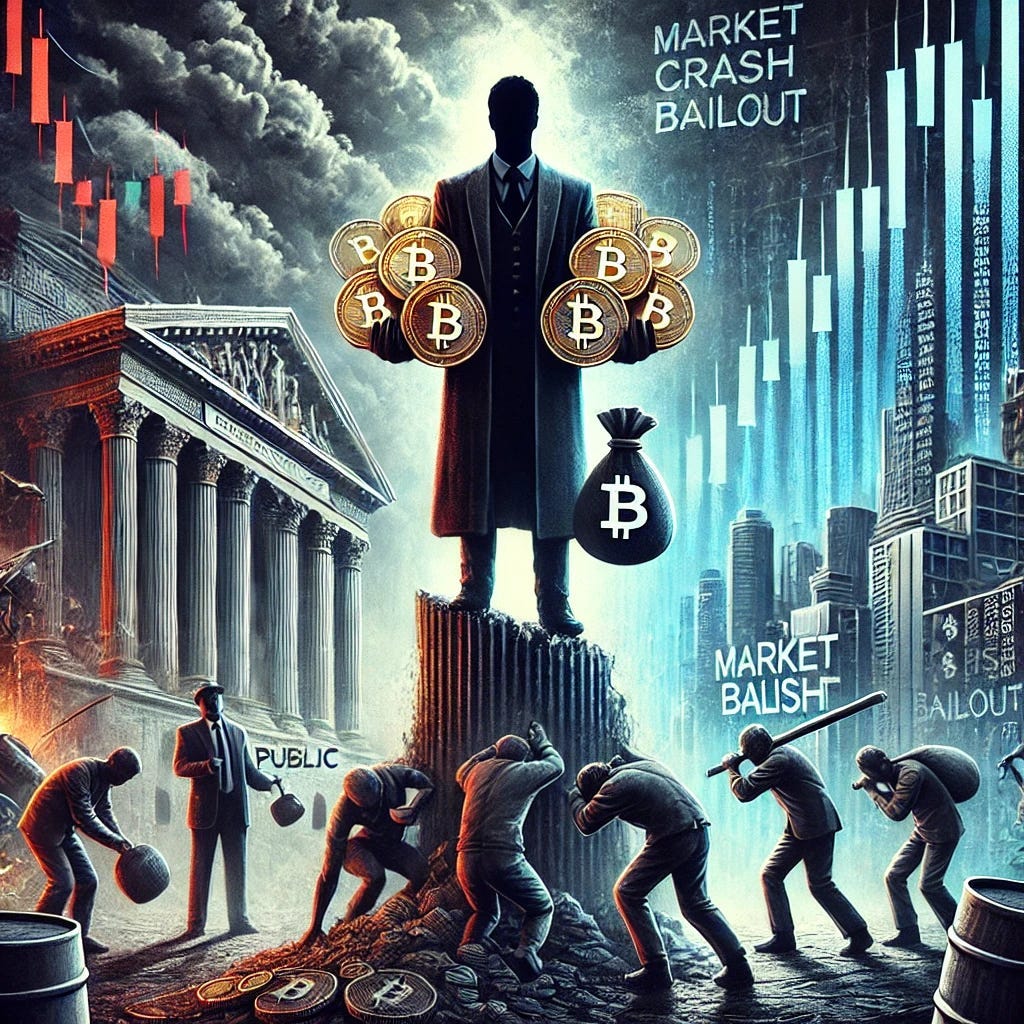

The collision of private gain and public trust.

As Trump intertwines personal profit with public policy, his embrace of cryptocurrency raises ethical concerns and potential risks for American taxpayers.

The Cryptocurrency Con: A Former President’s Venture into a Market at Taxpayer Risk

In an unprecedented turn, former President Donald Trump has embraced cryptocurrency — an asset class he once dismissed as a “scam” — not only as a personal investment but as a family business endeavor. With his holdings valued between $1 million and $5 million, and his family launching the crypto platform World Liberty Financial (WLFI), Trump has taken a bold, and arguably reckless, approach to intertwining personal financial interests with public policy. This shift raises significant questions about ethics, accountability, and the potential burden placed on American taxpayers.

The Trump Family Crypto Empire

Trump’s newfound enthusiasm for cryptocurrency is evident in several ways:

Personal Investments: Recent filings reveal Trump’s crypto portfolio includes Ethereum and other digital assets, with holdings ranging from $1 million to $5 million. Reports suggest he has gained substantially as the crypto market rallied during his presidential campaign and re-election.

World Liberty Financial: Managed by Eric and Donald Trump Jr., WLFI introduces WLFI tokens as a new digital currency. The family claims these tokens aim to “revolutionize” decentralized finance, but critics argue the project lacks transparency and prioritizes profits for the Trump family.

Policy Influence: Trump’s administration, if re-elected, has proposed establishing a “Bitcoin Reserve Fund” that would involve taxpayer funds purchasing cryptocurrency. This initiative is being marketed as a way to reduce national debt, but analysts call it a high-risk bailout for wealthy crypto holders.

The Implications of a Government-Backed Bailout

One of the most controversial aspects of Trump’s crypto involvement is the proposal to use taxpayer money to stabilize the cryptocurrency market. If the Bitcoin Reserve Fund proceeds, it could:

Artificially Inflate the Market: Government intervention could push Bitcoin prices higher, benefiting early investors like Trump and other crypto billionaires while exposing taxpayers to significant risks.

Subsidize Wealthy Investors: By pledging government funds to purchase and hold Bitcoin, the policy effectively shields wealthy crypto holders from market volatility.

Encourage Recklessness: Such a bailout creates a moral hazard, signaling that private investors can rely on public funds to rescue them from poor financial decisions.

The Convergence of Politics and Personal Gain

Trump’s crypto ventures blur the lines between personal profit and public policy, presenting potential conflicts of interest:

Crypto Advocacy as a Political Tool: Trump’s promotion of cryptocurrency aligns with his broader strategy of appealing to libertarian-leaning voters. However, it also conveniently enriches his personal portfolio and business ventures.

Crony Capitalism in Action: The family’s disproportionate control over WLFI token revenue — reportedly 75% — raises ethical concerns about using a political platform to promote a private enterprise.

Lack of Oversight: Trump’s push to deregulate crypto markets undercuts mechanisms designed to protect investors, increasing the likelihood of fraud and manipulation.

Lessons from History

The parallels between this situation and past financial crises are alarming. From the subprime mortgage debacle to the savings and loan crisis, history shows that government bailouts for risky, unregulated markets rarely end well for taxpayers. By positioning himself as a champion of cryptocurrency while advocating for policies that benefit his investments, Trump risks setting the stage for a modern-day financial catastrophe.

The Broader Impact on American Democracy

The implications of Trump’s crypto endeavors extend beyond financial markets:

Erosion of Public Trust: By intertwining private gain with public policy, Trump undermines confidence in the fairness of government actions.

Economic Inequality: Policies that favor wealthy investors exacerbate the wealth gap, placing the burden of market corrections on average taxpayers.

Global Perception: America’s pivot toward government-backed cryptocurrency holdings could destabilize traditional financial systems, impacting global markets.

A Call for Accountability

The rise of Trump’s cryptocurrency empire demands rigorous scrutiny. Policymakers and watchdog organizations must:

Demand Transparency: The Trump family’s financial disclosures and WLFI’s operations must be thoroughly investigated to ensure compliance with ethical standards.

Protect Taxpayers: Legislation must be enacted to prevent public funds from being used to prop up speculative markets like cryptocurrency.

Reinforce Oversight: Strengthening regulatory bodies like the SEC is critical to safeguarding against market manipulation and conflicts of interest.

However, Trump’s actions have consistently reflected self-serving motives, betraying the very principles of public service.

The Cryptocurrency Gamble

Trump’s pivot to cryptocurrency illustrates how personal ambition can intersect dangerously with public policy. As an elected official, one enters office with the responsibility to serve the people, prioritizing their needs and welfare over personal enrichment. However, Trump’s actions have consistently reflected self-serving motives, betraying the very principles of public service. His long history of financial contributions across the political spectrum further underscores a pattern of leveraging influence for personal and financial gain, regardless of ideological alignment.

By championing a volatile, unregulated market while proposing taxpayer-backed safety nets, Trump risks creating a financial quagmire that would disproportionately benefit a select few at the expense of the many. Such actions undermine public trust and highlight the dangers of blurring the lines between governance and personal profit.

As America navigates this new frontier of digital assets, the need for ethical leadership and robust oversight has never been more critical. The question remains: Will the allure of quick profits overshadow the long-term stability of the financial system? Or will democracy prevail, ensuring that public interests come before personal gain? The stakes have never been higher, and the answers will shape the nation’s financial and ethical landscape for generations to come.

The Cryptocurrency Gamble: Trump’s High-Stakes Con with Public Funds was originally published in Information-Warfare Magazine on Medium, where people are continuing the conversation by highlighting and responding to this story.