The Price of Untaxed Billionaires

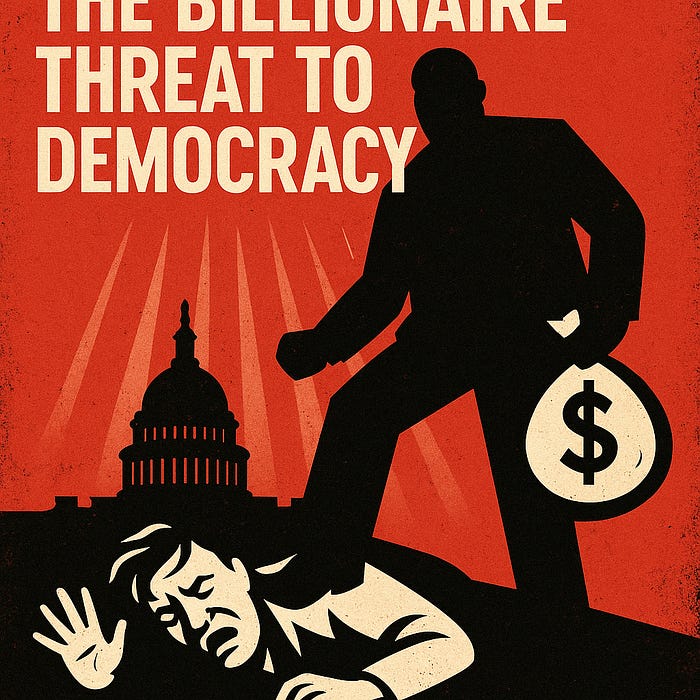

How Extreme Wealth Accumulation Threatens Democracy, Society, and the Human Spirit

In the modern age of globalization, automation, and technological acceleration, the economic divide between the ultra-wealthy and the rest of humanity has grown wider than ever before. Billionaire wealth has surged to astronomical levels — often beyond the reach of regulation or meaningful taxation. These fortunes, while portrayed as symbols of innovation or ambition, have become warning beacons signaling the dangers of extreme inequality. This essay explores the severe consequences of permitting a small elite to hoard wealth without redistribution, arguing that the unchecked rise of billionaire power undermines democracy, erodes social trust, fractures moral values, and threatens the collective future of civilization itself. By drawing from economic data, historical case studies, psychological research, and moral philosophy, we uncover the growing consensus: that a failure to reign in billionaire wealth risks not only societal collapse but the hollowing out of our shared human values.

The Economic Concentration: Global Data and Dangerous Trends

Global wealth inequality has reached a critical tipping point. According to the World Inequality Lab, the top 10% of people now hold more than three-quarters of global wealth, while the bottom 50% scrape by with a mere 2%. The rise in billionaire fortunes is even more alarming. In 2024 alone, the world’s billionaires added $2 trillion to their combined wealth, pushing their total holdings beyond $15 trillion. On average, this class of fewer than 3,000 individuals now owns more than the entire GDP of some continents.

The United States, once considered a land of opportunity, now mirrors the deep class divides of past aristocratic societies. The top 1% control about 35% of national wealth — levels not seen since the Gilded Age. In terms of inequality metrics like the Gini coefficient, the U.S. ranks among the worst developed nations, with figures exceeding 0.80. To put this in context, such figures rival or surpass inequality in feudal and colonial societies.

This extreme economic stratification is not just a matter of numbers. It reflects a structural malfunction, where capital begets more capital while labor is increasingly devalued. Without effective checks — like wealth taxes, progressive income tax, or estate duties — the system is locked into a loop of self-reinforcing disparity. When wealth becomes disconnected from work and reward, and instead flows disproportionately to ownership, speculation, and rent-seeking, the economy becomes extractive rather than productive.

History Repeats: From Robber Barons to Revolutions

Human history offers sobering reminders of what happens when inequality spirals out of control. The Gilded Age in the United States, a period from the 1870s to the early 1900s, was characterized by monopolistic giants — Rockefeller, Carnegie, and Morgan — amassing wealth at an unprecedented scale. Laborers toiled in hazardous factories, farmers were crushed by debt, and urban poverty soared. The public eventually revolted through the Progressive Era, demanding antitrust laws, labor rights, and the introduction of the federal income tax to prevent an oligarchy from solidifying.

Go back further to 18th-century France. The nobility and clergy lived opulently, largely exempt from taxes, while commoners faced famine, rising rents, and crushing levies. The imbalance led to the French Revolution — a violent recalibration of wealth and power. Rousseau’s warning that a social contract fails when “one man is rich enough to buy others, and another so poor he must sell himself” became a reality. The guillotine served as a brutal response to unchecked privilege.

Modern examples abound as well. Russia’s post-Soviet transformation in the 1990s saw the rise of oligarchs who used state asset privatization to seize entire industries. Wealth became the sole gateway to political and media influence, eroding democratic institutions and plunging millions into poverty. This pattern, where wealth accumulation without accountability leads to authoritarianism or revolution, remains one of history’s most consistent themes.

Empathy Eroded: Psychological Impact of Wealth

Wealth does not merely divide material conditions; it alters minds. Research in behavioral science and psychology shows that great wealth can diminish empathy, reduce ethical sensitivity, and increase narcissism. Experiments at institutions like UC Berkeley and the University of Amsterdam have demonstrated that wealthier individuals are more likely to cheat in games, ignore social norms, and express less compassion toward strangers.

This is not to say that all wealthy individuals are inherently unethical. Rather, the environments created by extreme wealth insulate individuals from the daily hardships of most people. Private jets, gated communities, and curated media bubbles create a world apart. Within that bubble, a “plutocratic mentality” often emerges: the belief that success is solely the result of merit and that the less fortunate are undeserving.

This growing empathy gap poses dangers for governance and leadership. Decision-makers who do not understand — or worse, dismiss — the experiences of the majority are less likely to champion inclusive policies. When the ultra-rich set policy through donations, lobbying, or media ownership, they may unknowingly or indifferently craft a world in their own image, detached from the needs of those they never meet.

Plutocracy Rising: How Wealth Captures Democracy

In theory, democracy grants equal political voice to all citizens. In practice, extreme wealth undermines this principle. Billionaires today possess the power to shape legislation, influence elections, and control public narratives. The Princeton study by Gilens and Page found that in the United States, the preferences of economic elites were far more predictive of legislative outcomes than those of average citizens. Democracy, in effect, begins to look more like an auction.

Campaign finance systems in many countries have opened floodgates to private donations, allowing billionaires to act as kingmakers. In the United States, Super PACs and dark money groups often fund entire electoral campaigns. Media ownership further concentrates influence, enabling wealthy individuals to dominate public discourse. From publishing platforms to social media networks, billionaire interests now filter what billions see and hear.

Even taxation policy reflects this bias. Saez and Zucman’s groundbreaking analysis showed that the 400 richest American families pay a lower effective tax rate than the average middle-class worker. Offshore havens, trusts, and legal loopholes allow for virtually unlimited asset protection. The erosion of the social contract is made worse when the public perceives that laws apply differently to the rich.

Social Fragmentation: The Collapse of Shared Reality

Extreme inequality corrodes not just economies but the social fabric itself. As societies grow more economically stratified, trust diminishes. Communities fracture along class, racial, and geographic lines. Shared spaces — from parks to schools to hospitals — become battlegrounds or disappear entirely. The public sphere atrophies, replaced by privatized islands of luxury and despair.

People lose faith in upward mobility, and hope gives way to alienation. Social scientists have long shown that high inequality correlates with lower levels of social trust, civic participation, and overall happiness. In these environments, populism, extremism, and conspiracy theories thrive.

Automation and AI introduce a new, deeper fault line. The very corporations that built fortunes atop a human labor force now deploy machines and algorithms to cut those same workers loose. As AI encroaches on fields from transportation to law, jobs vanish without viable alternatives. The profits, however, remain heavily concentrated. If those gains are not taxed to support Universal Basic Income (UBI) or similar programs, a vast underclass will emerge — unemployed, underpaid, and politically volatile.

Some of the ultra-rich have begun openly fantasizing about exiting society altogether — seeking to build self-contained “charter cities,” invest in private space colonies, or buy islands to escape civil unrest. This is not science fiction but a very real movement within segments of Silicon Valley and the financial elite. It reflects an ethos of abdication, not stewardship: a refusal to remain accountable to the civilization that enabled their ascent.

Moral Foundations: Fairness, Justice, and the Social Contract

Philosophical tradition holds that a society’s legitimacy depends on how it treats its least advantaged members. Thinkers like John Rawls proposed that just systems are those which distribute resources in ways that benefit everyone — especially the poor. Under Rawls’s “veil of ignorance,” few would choose to be born into a system that produces extreme billionaires but leaves millions in poverty.

Adam Smith, often miscast as a prophet of free markets, emphasized the moral sentiments necessary for market economies to function. He warned against monopolies and cronyism, arguing that markets must be grounded in justice. Piketty, Singer, and other modern thinkers have expanded this view, suggesting that wealth’s legitimacy derives not from its scale but from its utility.

The ethical case for taxing billionaires is clear. Beyond a certain point, excess wealth ceases to be productive — it becomes idle, speculative, or destructive. If taxed and redirected, those funds could fuel education, healthcare, climate action, and infrastructure. In a world of scarce resources and urgent needs, hoarding is not merely inefficient — it is immoral.

The Commonwealth Ideal and the Purpose of Economy

An economy is not a divine force or a natural law; it is a human construct designed to serve collective well-being. Everyone contributes to it — whether through labor, creativity, care work, or consumption. When its rewards flow overwhelmingly to a select few, the system has lost its way.

The idea of the commonwealth rests on shared prosperity. It asserts that the wealth generated within a society must benefit all, not just those at the top. It champions reinvestment over extraction, responsibility over escape. In such a framework, billionaires would not be outlaws or saviors — they would be participants, held to the same civic responsibilities as everyone else.

As automation and AI rewire the economy, the imperative grows stronger. Machines may replace workers, but they cannot replace society. If we allow wealth and technology to drift away from public accountability, we risk building a future where innovation exists without inclusion — where abundance coexists with abandonment.

Economic models must evolve, not just to remain viable but to remain human. Economies of scale, if not shared, become engines of division. The wealth of a society must be treated not as private treasure but as a collective trust. Otherwise, we abandon the very premise of civilization: that people, bound together by common purpose, can build something greater than the sum of their parts.

Conclusion: Wealth Without Responsibility Breeds Instability

We are at a crossroads. One path leads toward greater concentration of wealth, political oligarchy, and civic decay. The other leads to renewed democratic governance, equitable opportunity, and social resilience.

Unchecked billionaire wealth threatens far more than market balance sheets — it undermines the moral and institutional foundations of our world. From environmental degradation to democratic erosion, the cost of inequality is no longer theoretical. It is visible, measurable, and accelerating.

Yet the solutions are known. Progressive taxation, corporate accountability, public investment, labor protections, and global coordination can rebalance the scales. More than policy, what’s needed is a renewed commitment to justice — a belief that societies should be judged by how they treat the least powerful, not how they protect the most.

In the shadow of the singularity, we must decide: will technology liberate or enslave? Will wealth divide or unite? Will our future be built by many or ruled by few?

The answer depends on what we do next. Let it be a future worth sharing.