The Real Cause of America’s Debt: Tax Cuts for the Rich

Why the Middle Class Shouldn’t Be Left Holding the Bill

Decades of tax cuts for the wealthy have fueled an ever-growing national debt. It’s time for the richest Americans to finally pay their fair share.

For decades, Republican tax policies have consistently favored the wealthiest Americans under the guise of stimulating economic growth. From Ronald Reagan’s supply-side economics to Donald Trump’s massive corporate tax breaks, these policies have stripped the government of trillions in revenue while placing the burden of national debt squarely on the middle class. The result? A staggering national deficit, crumbling infrastructure, and social programs at risk — while the ultra-rich continue to thrive.

How Tax Cuts for the Wealthy Increased National Debt

Reaganomics: The Start of the Debt Spiral

The Economic Recovery Tax Act of 1981 slashed the top marginal tax rate from 70% to 50%, drastically reducing federal revenue. While Reagan’s administration later had to increase taxes to curb the rising deficit, the damage was done. The national debt soared from 33% of GDP in 1981 to over 53% by the end of his presidency. (scholars.org)

The Bush Tax Cuts: $5.6 Trillion in Lost Revenue

The 2001 and 2003 Bush tax cuts significantly reduced rates for high earners and cut capital gains taxes, overwhelmingly benefiting the wealthiest Americans. These cuts, coupled with two expensive wars and increased military spending, led to the addition of $5.6 trillion to the national debt by 2018. (truthout.org)

Trump’s 2017 Tax Giveaway: A Corporate Windfall

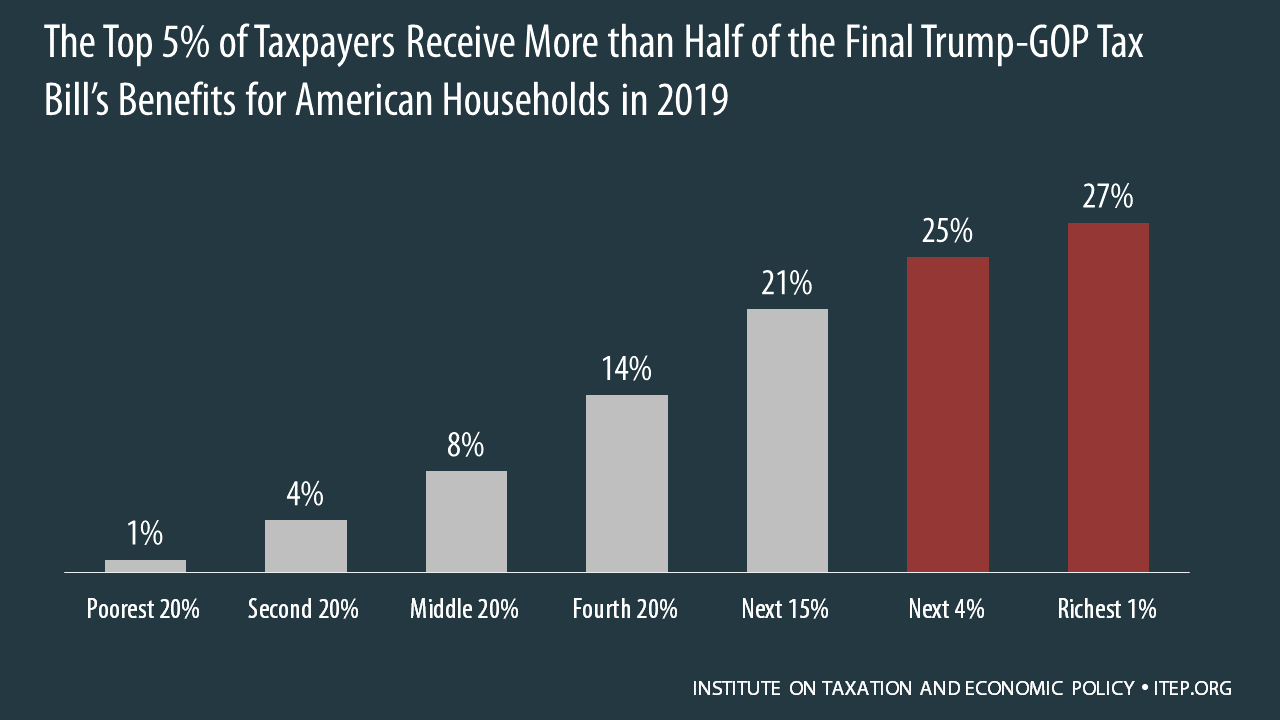

The Tax Cuts and Jobs Act of 2017 was marketed as a way to boost the economy and create jobs. In reality, it slashed the corporate tax rate from 35% to 21%, handed billions to major corporations, and provided the wealthiest Americans with disproportionate tax breaks. Instead of boosting wages or reinvesting in the economy, corporations used their tax savings to buy back their own stock, enriching CEOs and shareholders while adding $1.9 trillion to the debt. (budget.senate.gov)

Trump’s Proposed 2025 Tax Cuts: More Debt, More Inequality

Donald Trump has proposed additional tax cuts in his second term, including the elimination of taxes on tips, Social Security benefits, and overtime pay. While these measures might sound beneficial, they come with an estimated revenue loss of $5 to $11 trillion over the next decade, further increasing the deficit. (Fox Business)

The Middle Class Pays the Price

While the rich have enjoyed decades of tax cuts, the burden of paying off America’s growing debt has fallen on the middle class. Public services are underfunded, healthcare costs continue to rise, and vital social programs face cuts. Meanwhile, billionaires exploit loopholes to pay lower tax rates than teachers, firefighters, and nurses.

It’s Time to Tax the Rich and Reduce the Debt

If we want to get serious about reducing the national debt, we need to start by taxing the people who have benefited the most from our economy. Key policy changes could include:

Raising the corporate tax rate back to at least 28% to ensure that big businesses pay their fair share.

Implementing a wealth tax on individuals worth over $50 million to curb extreme inequality.

Closing tax loopholes that allow billionaires to shelter their wealth offshore.

Reversing the Trump tax cuts and ensuring that the ultra-rich contribute more to public funding.

Conclusion

The national debt crisis wasn’t created by excessive spending on social programs — it was driven by tax cuts for the wealthy that have drained government revenue for over 40 years. Instead of forcing the middle class to foot the bill, it’s time for the rich to start paying what they owe. The solution isn’t austerity or cuts to essential services; it’s a fair tax system that prioritizes economic stability over wealth hoarding.

No more excuses. No more tax cuts for the rich. It’s time to fix our broken system.

Well, they pay most of the taxes, so…