Trump’s Tariffs: Economic Strategy or Self-Serving Grift?

Are tariffs truly about protecting American jobs, or just another scheme to manipulate the markets for profit?

The Tariff Trap — Who Really Benefits?

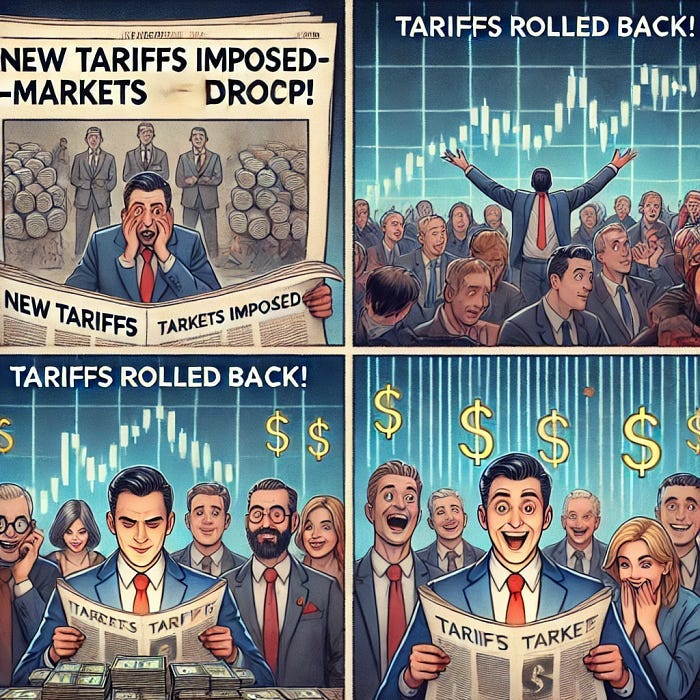

Step One: Announce tariffs — Stock market drops.

Tariff announcements can create market uncertainty, leading to stock price declines.

Investors, fearing higher costs and economic slowdown, often sell off stocks.

Step Two: Billionaires buy lots of stock.

When stock prices drop, wealthy investors (who have liquidity) can purchase undervalued stocks at a discount.

This step assumes that these investors expect a rebound and know the tariffs won’t last.

Step Three: Roll back tariffs — Stock market rebounds.

If tariffs are removed or softened, market confidence returns, and stock prices increase again.

The wealthy who bought in at low prices can now sell for a massive profit.

Underlying Implications:

This describes a form of market manipulation, where policy decisions are intentionally used to create temporary fluctuations.

Those with inside knowledge or access to policymakers can exploit these swings before the general public can react.

The cycle illustrates a way that wealth accumulation becomes self-perpetuating, benefiting those already in power.

Real-World Examples:

The Trump-era trade wars (2018–2019) saw massive tariff announcements, followed by partial rollbacks, causing wild market swings.

Reports have suggested that key financial players were able to capitalize on these movements.

Trump’s Tariffs:

Economic Strategy or Self-Serving Grift?

In recent years, the United States has witnessed a series of tariff implementations under President Donald Trump, sparking debates about their true intent and impact. While tariffs are traditionally used to protect domestic industries and address trade imbalances, the erratic nature of these policies raises questions about whether they serve national interests or personal agendas.

The Tariff Rollercoaster

President Trump’s approach to tariffs has been marked by sudden announcements, subsequent withdrawals, and frequent reversals. For instance, in early 2025, a 25% tariff was imposed on goods from Mexico and Canada, only to be paused shortly after, leading to market instability and investor uncertainty. Such unpredictability has strained relationships with key trade partners and contributed to global economic uncertainty.

Economic Implications

The fluctuating tariff policies have had tangible effects on the U.S. economy:

Market Volatility: The imposition and subsequent reversal of tariffs have led to significant market fluctuations, affecting investor confidence and potentially leading to broader economic repercussions.

Consumer Prices: Tariffs often result in increased costs for imported goods, which can lead to higher prices for consumers. This inflationary pressure affects household budgets and overall economic well-being.

Global Trade Relations: Erratic tariff implementations have strained relationships with allies and trade partners, leading to retaliatory measures and a potential decline in international cooperation.

Motivations Behind the Tariffs

The inconsistency and timing of these tariff policies have led to speculation about their underlying motivations:

Economic Strategy: Proponents argue that the tariffs are designed to protect domestic industries, reduce trade deficits, and encourage fair trade practices.

Personal Gain: Critics suggest that the unpredictable nature of the tariffs may be leveraged for personal or political gain, allowing those with insider knowledge to capitalize on market movements.

Conclusion

While tariffs can be a legitimate tool for economic policy, their effectiveness depends on consistent and strategic implementation. The erratic nature of recent tariff policies under President Trump has led to economic uncertainty, market volatility, and strained international relations. Whether these actions stem from a genuine economic strategy or serve other interests remains a topic of debate.

Understanding the true motivations and consequences of such policies is crucial for assessing their impact on the nation’s economic health and global standing.